It's not too late to attain Financial Wellbeing

4 quick questions to get you started on the yellow brick road

Did holiday spending leave you buried in credit card bills? Do you worry constantly about how you will make to next pay check? Do you worry incessantly about how you'd make it if you lost your job? Do you think you need to buy a house no matter what or are you fine just renting?

A lot of these questions and their answers depend on your current financial situation.

We all are clear in our minds that 'being employed' is key to being independent. We have all done our rounds of odd jobs to meet those unexpected expenses, but have we really sat down and evaluated whether our finances meet our aspirations, ongoing needs, and plans? Are we on the path towards Financial Wellbeing?

Ask yourself these 6 questions before initiating a financial wellbeing plan

- Has the $10 that you first put in your piggy bank converted to a $100 or $1000 in your savings account?

- If you are a college grad, you may have a debt of over $25,000. Has your debt decreased? Or, has it increased in leaps after graduating considering all your outstanding credit card bills, family commitments, and other loans?

- Have you bought a house and are you spending more than 30% of your income towards that mortgage? Is this expense leaving you enough for other daily expenses or pleasures?

- Do your employer offer health and retirement savings benefits? If so, do you have a good understanding of them and how they can benefit you and your dependents?

- Are you and your family members leading a healthy lifestyle? Are you monitoring wellness to keep healthcare expenses under control?

- Do you know how much your retirement income will be - from pensions, social security, and savings? How about your retirement expenses?

What is "Financial Wellbeing"?

As defined by Consumer Financial Protection Bureau - "Financial wellbeing is a state of being wherein you:

- Have control over day-to-day, month-to-month finances;

- Have the capacity to absorb a financial shock;

- Are on track to meet your financial goals; and

- Have the financial freedom to make the choices that allow you to enjoy life."

National Wellbeing Statistics in the US

According to popular research conducted by World Bank on Financial literacy, "US ranks only 14 in the world when it comes to financial literacy." Which means that most people do not have the know-how or adequate training to make most of the financial decisions in their life - like saving, making investments, taking loans etc. To gauge the financial literacy quotient, the research by World Bank measured the responses for knowledge of simple interest, interest compounding, inflation and risk diversification. Findings show that "On an average, 55 percent of adults in the major advanced economies - Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States - are financially literate." In the United States, Financial Literacy among adults stands at 57%.

Still not convinced? Look at some stats and key findings on financial wellbeing, according to the National Financial Wellbeing Survey, conducted in the US,

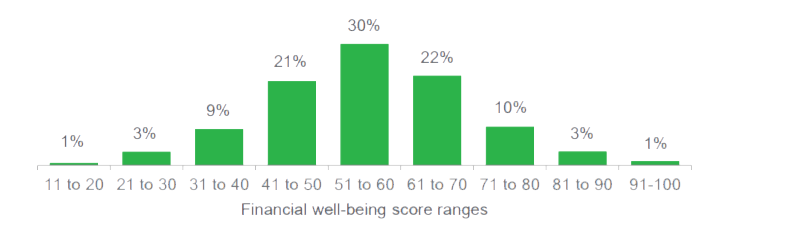

"The average financial wellbeing scores for U.S. adults is 54. 70 percent of adults fall below 51 or above 60 (with 13 percent of scores at or below 40 and 14 percent above 70)."

Data Source: National Financial Wellbeing Survey, Consumer Financial Protection Bureau, 2017

Other interesting findings of the survey were, that the average financial wellbeing score varied for certain individual characteristics:

- Persons with a college education the scores were above 58.

- For older adults 45 and above, the score ranged from 54 to 60.

- Adults who rated themselves having excellent or very good physical health scored 58.

- Gender wise both males and females have an equal score of 54.

Summarizing the findings of the research, there are many opportunities available to improve financial wellbeing. Incorporating positive attitudes towards spending and saving, adopting long-term planning, and consistent or routing financial management practices that you may educate yourself on are key towards Financial Wellbeing.

How to improve your Financial Wellbeing quotient?

Do these old adages ring a bell?

"Save for a rainy day!"

"Don't let money burn a hole in your pocket!"

"Money doesn't grow on trees!"

Though antique, these very basic principles still ring true in today's world. As you advance your financial literacy and move to seek financial advice, and use the latest apps and tools, make sure you are following these simple tips:

- Make managing finances a routine for you.

- Seek reliable and relevant information.

- Set goals, track and plan your activities around it.

- Live within your means.

- Follow your financial decisions without excuse.

The bottom line is that personal behaviors, knowledge, and skills are the key factors that determine your financial wellbeing. Throughout our productive years, we need to build safety nets which will help in better managing our finances to cover planned and unexpected events, build our wellness index and take us through our retirement years peacefully.

Data Source: Consumer Financial Protection Bureau, The Standard & Poor's Ratings Services Global Financial Literacy Survey.